Elective coverage opt in

Elective coverage opt in

You are self-employed if you are:

- A sole proprietor

- A joint venturer or a member of a partnership

- A member of a limited liability company (LLC)

- An independent contractor (as described in RCW 50A.05.010 (8) (B) (iii).

- Otherwise in business for yourself.

Note: Corporate officers are not self-employed. S-Corp is a tax classification, not a business entity type. Although an LLC may be designated as a S-Corp for federal tax purposes, it is treated as an LLC for Paid Leave purposes because that is how the entity is registered with the state.

Opting in

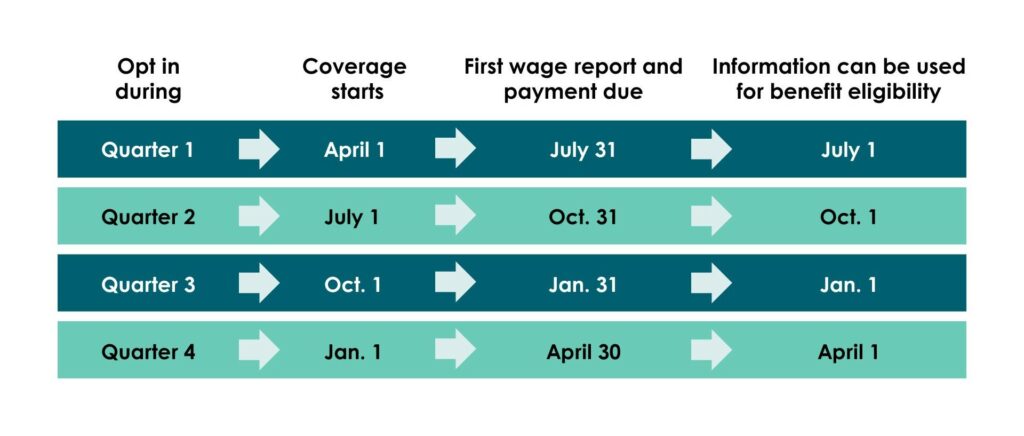

The Elective Coverage start date is the date you start tracking your self-employment earnings to report to us. It’s not necessarily the same date that eligibility for benefits will start. We need at least one reported quarter to use self-employment earnings for benefit eligibility. For more information, review our Elective Coverage Toolkit.

You can opt in to multiple programs.

You can opt in to Paid Leave, WA Cares or both programs. There’s also an option for rideshare drivers to opt in to a Pilot Program specific to Paid Leave. Click here to find more information on WA Cares elective coverage.

Paid Leave coverage length

When you opt in to Paid Leave, you opt in for an initial period of 3 years. At the end of those 3 years, you may withdraw and end your coverage. This option is available for 30 days. If you do not withdraw, your coverage will automatically renew for 1 year, and you’ll be able to end coverage after that year ends. If you withdraw, your coverage will end on the last day of your enrollment period.

TNC Pilot coverage length

When you opt in to the TNC Pilot, you opt in for an initial period of one quarter. At the end of each quarter, you may withdraw and end your coverage. This option is available for the month after the quarter ends. If you do not withdraw, your coverage will automatically renew for another quarter. If you withdraw, your coverage will go through the last day of the current quarter.

Example: You opted into the TNC Pilot on July 1, 2024. Your coverage takes effect on Oct. 1, 2024. On Jan. 15, 2025, you withdraw from the pilot. You will see your coverage period goes from 10/01/2024 – 03/31/2025. You will need to submit quarterly reports in January and April.

Rideshare drivers who enroll in the TNC Pilot can withdraw from the TNC Pilot in their elective coverage account, not through a third-party. This includes drivers who enrolled through a third-party. This option is available to rideshare drivers for the month after the end of each quarter of eligibility.

Elective Coverage covers all of your self-employed income.

You do not have to opt-in separately for each business you own, but you do need to report all of your self-employment income. If you did not have any self-employment income in a quarter, you must still file a report for that quarter. For more information, visit our Elective Coverage Reporting page and review our Elective Coverage Toolkit.

After opting in

When you sign up for Paid Leave, you agree to pay the employee share of the Paid Family and Medical Leave premium for yourself for three years. After that, you can participate on an annual basis.

Report your earnings every quarter.

To take leave after you sign up, you need to have met the requirement for hours worked and have a qualifying event. You must have worked a minimum of 820 hours in Washington during the qualifying period. The 820 hours can be from your self-employment or combined from multiple jobs.

For self-employed wages, the state determines your hours worked by dividing your reported wages by the state minimum wage.

LLC owners (members), partners, sole proprietors and other types of self-employed individuals are not required to participate. If you have employees, you must report their hours and wages, but you do not have to include yourself.

Questions? Email us at paidleave@esd.wa.gov

To get you to the right team, include “SELF-EMPLOYED” in the subject line.