Elective coverage reporting

Elective coverage reporting

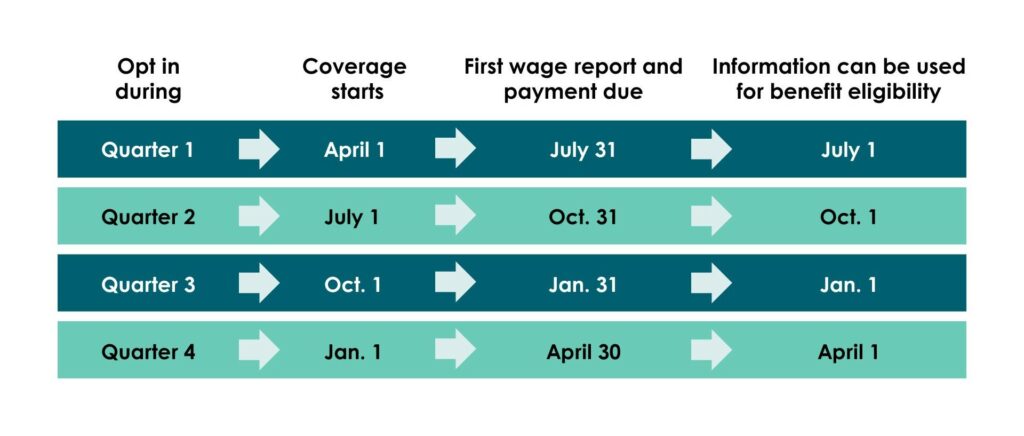

When to file quarterly reports and pay premiums

You start filing quarterly wage reports after the first quarter when your elective coverage starts.

When you elect coverage, you elect coverage as an individual, not a business. This means you will report self-employment income from any and all of your businesses.

As defined in the law, you should report your net income AND any gross wages you paid yourself through your business(es).

If you didn’t make any money through self-employment for a quarter, you still have to file a quarterly report. You’ll enter zero for that report.

You will only report self-employment income, not hours worked. To determine the hours you worked in a given quarter, we will divide your reported self-employment by minimum wage for that quarter’s year as defined in the law with a maximum of 820 hours.

You will only pay the employee share of the premium.

You are not responsible for the employer’s share of the premiums.

Use the premium estimator to estimate your premiums.

- Log in to your elective coverage account.

- Select $ Payments in the top menu bar then Make Payments.

- On the ‘Pay Your Premiums’ screen, you will be able to pay for any program where you have active coverage or a balance due.

Premium payments for Paid Leave and WA Cares are separate because they must be paid to the appropriate program accounts.

Regardless of program, we offer three methods to pay premiums:

Pay by ACH: You will be taken to a secure third-party payment processor. It’s important that you do not close your browser during the payment process. Once your payment is complete, click Exit to return to your account.

Pay by card: You will be taken to a secure third-party payment processor. It’s important that you do not close your browser during the payment process. Once your payment is complete, click Exit to return to your account.

Note: You will be charged a 2.9% convenience fee with this option.

Pay by check/money order: Download and print the payment coupon for the program you’re paying premiums for. Attach your payment and mail it to the address on that form. Processing times will be longer than 3-5 business days. We do not accept foreign currency.

Payments can take several days to post to your account depending on your payment method.

Some common reasons for delays in payment posting include:

- Not enclosing the correct program payment coupon when mailing your payment

- Postdating your payment to a date later in the month

- Sending your payment to the wrong program

- Not including your customer ID on your payment

If it’s been more than a week since you made your payment online and your balance isn’t updated, please contact us at paidleave@esd.wa.gov.

Amendments

If you need to update the amount of self-employment income you reported:

- Click on Wage Reporting from the top menu bar then Wage Submission History.

- Find the wage report you need to amend.

- Click the Amend hyperlink.

- Update the dollar amount and click Next.

- Review what you entered, complete the ‘Employment and Wage Detail Certification’ then click Submit.

- If you successfully amended your report, you will see a Confirmation Page.

Employer agents can report on behalf of an elective coverage customer

Bulk file or amend reports for your clients with an ICESA file. Paid Leave and WA Cares have different bulk filing specifications than other state agencies.

Bulk pay using ACH credit. To get the instructions for ACH credit payments, email paidleave@esd.wa.gov with “Request: Bulk Payment Instructions” as the subject.

Here’s when to submit your reports and payments:

- Report & Payment Due: April 30

- Q1: January, February, March

- Report & Payment Due: July 31

- Q2: April, May, June

- Report & Payment Due: October 31

- Q3: July, August, September

- Report & Payment Due: January 31

- Q4: October, November, December

For more information, review the Elective Coverage Toolkit.

Questions? Email us at paidleave@esd.wa.gov

To get you to the right team, include “SELF-EMPLOYED” in the subject line.