Transportation Network Company (TNC) Pilot

Transportation Network Company (TNC) Pilot

A pilot for rideshare drivers

As of July 1, 2024, there’s a new way for rideshare drivers to participate in Paid Leave: They can opt in to the Transportation Network Company (TNC) Pilot.

If you drive passengers for a TNC, sometimes called a ridesharing company, you can opt in to the pilot. This means the money you make as a rideshare driver can be used to establish eligibility toward taking Paid Leave benefits in the future. When you opt in, you must report your compensation and pay premiums every quarter. Rideshare drivers participating in this pilot will have fully paid premiums reimbursed by their TNCs.

Who can join?

If you are a rideshare driver you can opt in. A TNC is a company that uses a digital network to connect passengers with rideshare drivers to provide prearranged rides.

Examples of TNCs in Washington state:

- CiRide

- Curb Mobility

- Hop Skip Drive

- Lyft

- Moovn

- Uber

- Via

- Wingz

Are you a rideshare driver? Check your eligibility:

- Do you drive your own vehicle in WA State?

- Do you use a website or phone app to find passengers/people?

- Is the ride prearranged?

If you answered yes to all these questions, you’re likely a rideshare driver.

Note: Food and goods are not considered passengers, and earnings from transporting these items will not count. The law that applies is RCW 48.177.005.

Example: If you prearrange a trip in your vehicle to drive people to food, you may be a rideshare driver for that trip. If you prearrange a trip in your vehicle to drive food to people, you are not a rideshare driver for that trip.

Two ways to opt in as a rideshare driver:

Option 1: Self-enrollment

- Create or log in to your SAW account. (Watch our video on creating a SAW account)

- Add Paid Family and Medical Leave to your services.

- Create or log in to your elective coverage account, and

- Opt in as a Driver and provide the necessary enrollment information.

Option 2: Enroll through Drivers Union

Drivers Union can help with enrollment, wage reporting and premium payments. Contact them for more information.

After you opt in

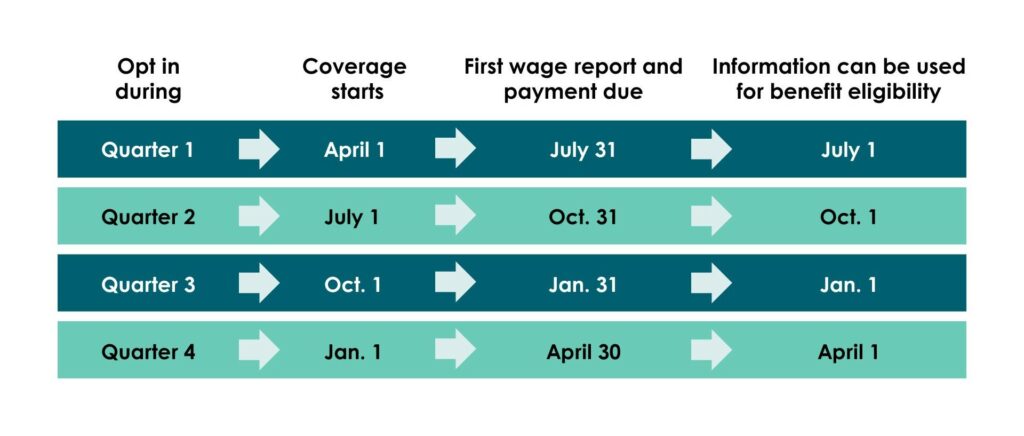

After you opt in, your coverage starts the first day of the following quarter. You must file reports after each quarter of coverage ends.

Example: If you opt in anytime from July 1 to Sept. 30, then your coverage starts on Oct. 1, the first day of the next quarter. You will file your first wage report for Quarter 4 (October, November and December) by Jan. 31.

If you opted in through the Drivers’ Union, contact them with any questions about quarterly reporting on your behalf. If the Drivers’ Union cannot report on your behalf, you can file your own wage reports.

When to file quarterly reports and pay premiums

You start filing quarterly wage reports after the first quarter when your elective coverage starts.

Pilot program timeline

- Each TNC you drive for will give you or your third party a compensation report by the 15th of each reporting month – January, April, July, October. Add up all the reports the TNCs give you to report your ‘Net Compensation.’

- If you enrolled individually, reach out to the TNCs you drive for and provide them with your Elective Coverage Customer ID before your first reporting month starts.

- By the last day of the reporting month – January, April, July, October – you must report your net compensation. If you didn’t make any money as a rideshare driver, you will report $0.

- Then, 15 days after the reporting month ends, the Employment Security Department (ESD) will send TNCs a report so they can reimburse their drivers. The report will have the following information:

- Elective Coverage Customer IDs for all drivers currently or formerly enrolled in the pilot.

- Coverage Dates for all drivers currently or formerly enrolled in the pilot.

- Whether or not a driver filed a wage report in the quarter.

- Whether or not the driver’s account is paid in full.

- If the Drivers’ Union reported and paid on the driver’s behalf.

- TNCs have 15 days after receiving the report from ESD to reimburse drivers paid premiums. If you have a balance due on your Paid Leave account, you will not be reimbursed by the TNC, so make sure to pay any outstanding balances due on your account.

Using Paid Leave

When you opt in, we calculate your hours worked by dividing the amount you made by the state minimum wage. The 2025 Washington state minimum wage is $16.66.

Example: If you made $6,664 as a TNC driver from Jan. 1, 2025 to Mar. 31, 2025, the calculation would be $6,664 divided by $16.66, which equals 400 hours.

After you complete your first quarter of coverage, you’ll be eligible to receive benefits if you:

- Have at least 820 hours worked through any combination of employment and elective coverage in your qualifying period, and

- Experience a qualifying event.

For more details, see our Benefit Guide.

Withdrawing from the TNC Pilot

You can withdraw from the pilot at the end of each quarter of active coverage. The option to withdraw is available for the first month after a quarter ends. For withdrawal steps, read through the Elective Coverage Toolkit.

The pilot continues until Feb. 15, 2029. The last reporting quarter is 2028 Q4.